Hurricane Sally Property Injury Claims

Content

Our firm is devoted to representing and fighting for the rights of the injured. Robert E. Gordon is a personal damage attorney and founding member of the legislation Offices of Gordon & Partners. When failing to completely pay a claim, not offering you with a written explanation of the factual foundation and incorporating language of the coverage.

Your auto insurance coverage policy, not your owners, would cowl this damage should you carry comprehensive protection. Contact the insurance provider to file a claim in a timely manner. For owners, your provider could present an inventory of contractors and provide advice on do-it-yourself tips to prevent further damage.

Particles Removal Protection

This would come with boarding up windows, placing plastic tarps over holes in the roof and drying out moist carpets and furniture. Keep receipts for supplies used and maintain a record of the repairs you make for the adjuster. Filing a claim after a catastrophe or severe climate occasion is basically no different than after a fender-bender. Claims may be filed on-line, over the cellphone, and on the cell app. In the event of a large-scale catastrophe, our GEICO Catastrophe Response Team may be out in the field serving to customers file claims and providing help to those in need. Protect your house the best way it protects you by selecting the property insurance protection that meets your wants. Here's an summary of what's sometimes included in a householders coverage, in addition to another things to contemplate based on where you reside and what you own.

In order to cover that damage, you may have to purchase separate flood insurance. In most circumstances, owners insurance coverage that folks of Colorado buy for a house often cover damages accomplished to your own home by wind and rain from a hurricane. You will have to pay out a separate hurricane deductible if you plan to claim hurricane injury. In addition to that, you'll have to achieve this even earlier than you get paid out any coverage or compensation on your property injury. CFA believes that Hurricane Ida will produce about $19 billion in insured losses, cut up between personal insurers for the wind damage and the federal government’s National Flood Insurance Program for flood harm. CFA estimates that personal insurers will face over 180,000 claims for wind damage by owners with insurance coverage funds for wind injury exceeding $12 billion. The NFIP will, in CFA’s estimate, handle as many as a hundred,000 flood claims for over $7 billion, given the severity of the storm surge and the rainfall totals.

Unfortunately, commercial property harm insurance policies can exclude or severely limit protection for flooding caused by a natural catastrophe. Owners are suggested to safe a separate flood harm coverage via the National Flood Insurance Program to recover costs for harm to the muse, electrical techniques, structure, and contents. Many regulation corporations advertise they litigate property insurance claims, but whenever you dig deeper, additionally they work in many extra areas of apply. At Merlin Law Group, our practice is devoted to representing policyholders and litigating their insurance claims. Our firm has efficiently litigated and recovered damages for greater than 100 million dollars for an insured on a single case.

Find The Best Colorado Homeowners Insurance Lawyer To Sue Your Insurer For Denying Your Declare

Claims greater than $100 however lower than $300,000 may be lined by the warranty, aside from house owner's insurance required to offer $200,000 additional coverage towards structural or content harm claims. Tornadoes -Homeowner's insurance coverage insurance policies usually cowl such damages, but once they happen, you should document them immediately and contact your policyholder.

September is the the peak of hurricane season. Stay in the know, and keep yourselves and your property ready and protected. Should you experience any property damage and need help with a homeowners insurance claim, give us a call. It’s free!

— Law Offices of Rina Feld (@feld_rina) September 10, 2021

#delayedclaim #homeownersclaimdenied pic.twitter.com/0zcH6ROIhO

If the bids are too high, ask the adjuster to barter a greater price with the contractor. Adjusters may recommend companies that they have labored with earlier than. Some insurance coverage companies even guarantee the work of companies they recommend, however such applications are not out there everywhere. Suppose, for instance, a tree fell via the roof onto your eight-year-old washer. With a alternative cost policy, the insurance coverage company would pay to replace the old machine with a brand new one.

The attorneys and employees at Smith & Vanture are skilled in making insurance companies pay for all harm carried out to your home. In most instances, if we're successful making the insurance coverage company pay the disputed declare, the insurance coverage firm will be required to pay our fees and costs. Whether your claim is giant or small, we may find a way to assist you to with the claim process from start to end. It’s essential to check your policy and be certain that your homeowners’ insurance coverage policy covers flood harm.

What does insurance cover after a hurricane?

Buildings insurance policies usually cover financial loss caused by storm damage. There are occasions where rain, hail, or snowfall by itself can constitute storm. Any extreme form of bad weather has the potential to cause damage to a property.

This safety could probably be helpful if the value of your contents is more than your insurance coverage protection. For occasion, you simply bought a brand new TV that is destroyed throughout a hurricane. It is a good idea to have a listing of all of your belongings if you have to file a hurricane injury declare for the contents of your house.

Our firm has efficiently litigated a selection of property harm claims and recovered damages for our shoppers that allowed them to proceed pursuing their goals. The last thing you want is to search out yourself upside down on the losses from a disaster and struggling to rebuild your corporation or your life. Our regulation firm has been working with purchasers who've sustained property damage and loss on account of a hurricane since our inception. We have a wealth of expertise dealing with hurricane-related claims, and a track record of glad clients who have been able to receive the compensation they deserved. Although you must all the time consult with an insurance coverage claim professional when placing a significant property injury declare, the next insurance coverage claim tips will assist you to by way of the declare process. Gulf Coast states each have an relevant statute of limitations dictating by when a declare must be filed.

To discuss challenges associated to your insurance dispute, name our Colorado property insurance attorneys at present for a free consultation. Fully grasping the distinctions between windstorm and flood claims could be troublesome without the help of a lawyer. Moreover, there can be much overlap and “grey area” with the two. An experienced hurricane property harm attorney can assess your state of affairs and determine the ideal plan of action. If this is the case, you could shop around for hurricane insurance coverage quotes to see if other insurers in your space will cowl you for hurricane injury. You may also see if your present insurer would add windstorm coverage to your policy. Insurance disputes may be time-consuming and tough to navigate alone.

Tips On How To Get Hurricane Insurance Coverage

Send us your questions or ask to set up a free preliminary consultation. If you do need help with a claim drawback, contact the Mississippi Insurance Department. In the event of catastrophic destruction resulting from a hurricane, MID will arrange a local claims processing assistance middle to assist residents with their claims.

How long after a hurricane can you file a claim?

The insurance adjuster will inspect your roof and the exterior of your home for visible signs of damage. If not, the adjuster will catalogue the damage and submit it for evaluation to the insurance company. The company will pay fair market value to repair your roof so it meets the requirements for local codes.

Some corporations do offer sure coverage enhancements or endorsements that need to be bought individually, that will embody protection for meals spoilage. Floods, earthquakes, authorities seizures, mudslides, ordinance updates, sewer backups, and sinkholes are perils that will not be covered by homeowners insurance, according to Hippo Insurance. If you've heard any of the next statements from your adjuster, call us instantly and we will resolve your unhealthy faith insurance coverage declare for you. It’s necessary to totally review your insurance coverage to grasp exactly what is roofed and what type of compensation you are entitled to obtain. Flood insurance isn't usually included in a homeowners’ insurance coverage.

- Yet just 1 inch of water in your home could cause as a lot as $25,000 value of injury, according to the Federal Emergency Management Agency.

- Once an adjuster visits the property and assesses the harm, they may either settle for or deny the declare.

- Some hurricane and flood coverage features a ready interval after you buy a coverage, so you would be out of luck if you waited until the last second to purchase a policy.

- If you've hurricane rated windows, doorways, and storage doors, this could suffice.

- This storm caused a total $12 billion in damages and that quantity might have been a lot larger if the storm immediately struck Houston.

This is simply why it is inspired to contact a public adjuster at the early stages of your claim. Floridian International Adjusters can help residential property homeowners on new claims, underpaid claims, and even claims which were denied protection underneath your householders coverage. Non-flood associated damage caused by Eta should fall beneath your homeowner’s insurance coverage. Non-flood related damages can be roof harm, roof leaks, window injury from flying debris, tree injury, fence harm and so on. Because Eta was not classified as a hurricane for very lengthy, it's going to doubtless not be categorized as a hurricane for purposes of insurance claims for the most of the injury it triggered all through Colorado. The distinction between whether Eta was a hurricane or tropical storm is important when figuring out what insurance deductible applies.

To illustrate the situation, State Farm received greater than 35,000 insurance claim purposes in the week following Hurricane Laura. Under legislation, insurance firms may be required to pay further damages and compensation, plus attorneys charges, in the event of undue delays. Many householders make the incorrect assumption that their homeowner’s insurance coverage coverage contains flood coverage. However, you are solely coated for flood harm if you have bought a specific coverage from the National Flood Insurance Program , which works at the side of the Federal Emergency Management Agency . Our insurance coverage claims lawyers in Colorado, Mississippi and Louisiana know that living in the path of hurricanes is a half of the price we pay for the sweetness we enjoy throughout the State of Colorado, Mississippi and Louisiana. If an insurer knows your home is in the path of a hurricane, they simply won't give you protection till after the storm passes.

If your personal home is unsafe to occupy because of the extent of the injury, notify your insurance firm about discovering one other place to stay whereas repairs are being made. Some insurance policies have extra coverage for living bills during this time.

Who gets the insurance check when a car is totaled?

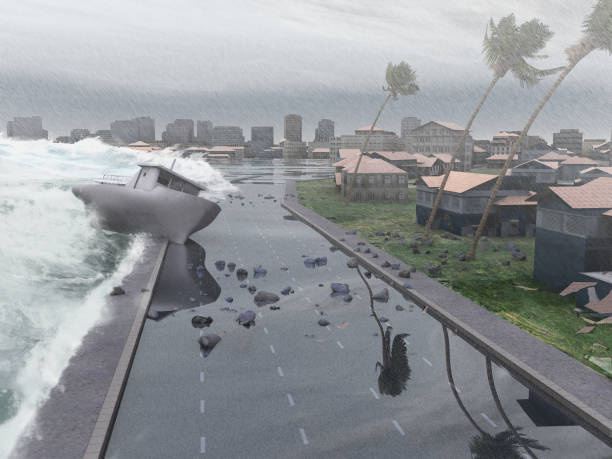

These hazards include heavy rains, high winds, a storm surge, and even tornadoes. Storm surge pushes seawater on shore during a hurricane, flooding towns near the coast. Heavy rains cause flooding in inland places as well.

Once you’ve fulfilled your duties by reporting your declare in thorough detail, flip the burden to the insurance company. Demand that they ship a claims adjuster to your property instantly to doc the harm.

Our hurricane insurance coverage lawyers have years of experience working FIGA claims and will fight to make sure your settlement claim is justified. Homeowners can choose a contractor to perform repairs when loss or injury happens. Recommended contractors might have agreements with your insurance coverage company, however are not liable contractor-related points in the occasion that they occur. Insurers offering residential insurance coverage protection can contract qualified constructing contractors with expertise working with hurricane-related injury beneath Colorado law. As talked about, adjusters may be in a rush or might skim over the property if they're experiencing a backlog of claims. If you realize someone corresponding to an engineer who can communicate to the damage of your property , the insurance company is obliged to issue in their suggestions. Be positive also to document additional living bills ; these can embody costs of temporary housing/hotel stays, travel expenses , power turbines, rental automobiles, and different prices.

Once you've cleaned up your property and you may be prepared to start repairs, be careful of home restoration scams. Log into review billing history, replace payment methods, and more. Bankrate is compensated in exchange for featured placement of sponsored services and products, or your clicking on links posted on this web site. This compensation could impression how, the place and in what order merchandise seem. Bankrate.com doesn't embody all firms or all obtainable products.

Many Texans misplaced power in the course of the storm and suffered water injury from the 16 inches of rainfall. This specific hurricane caused simply over $1 billion in damages. When you file a reliable declare and there appears to be no progress, contact your insurance company to seek out out the standing. The law protects you in opposition to "dangerous religion" insurance practices, including the failure to affirm or deny the coverage of your claim inside a reasonable time interval. In 2005 and 2008 the Gulf Coast was hit by two of probably the most devastating hurricanes in U.S. historical past. Hurricane Katrina struck in 2005 and left 1,800 people lifeless in its wake, with financial losses estimated at near $110 billion.

Flood injury just isn't lined by your homeowner’s or hurricane policies. Hurricane injury to your car is usually covered as lengthy as you carry complete insurance in your auto coverage. Dwelling coverage covers the construction of your own home, your roof and built-in appliances such as your water heater or kitchen cupboards. You typically purchase this protection equal to the whole rebuild cost of your house. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in change for placement of sponsored products and, companies, or by you clicking on certain hyperlinks posted on our web site.

September is the the peak of have a peek at this site hurricane season. Stay in the know, and keep yourselves and your property ready and protected. Should you experience any property damage and need help with a homeowners insurance claim, give us a call. It’s free!

— Law Offices of Rina Feld (@feld_rina) September 10, 2021

#delayedclaim #homeownersclaimdenied pic.twitter.com/0zcH6ROIhO

Your adjuster can't essentially provide the authority to submit the shape after the 60 days move. Another assumption some people make is assuming if they've homeowner’s and hurricane insurance policies they're protected towards flooding. However, that isn't the case when it comes to damages attributable to flooding.

An NC man’s warning to homeowners about insurance disputes after Hurricane Florence - CBS17.com

An NC man’s warning to homeowners about insurance disputes after Hurricane Florence.

Posted: Tue, 14 Sep 2021 02:18:30 GMT [source]

The Gulf is prone to tropical storms because of the warm local weather. Probably probably the most notable storms from the early part of the 20th century are the 1900 and 1915 Galveston Hurricanes.

Experienced catastrophe restoration attorneys at Colorado legislation agency Ged Lawyers, LLP have firsthand information of the hurricane insurance coverage claims process. Our skilled staff aggressively fights insurance corporations for what's rightfully yours under the terms of your homeowner’s insurance policy till we reach the specified end result. We have collected hundreds of thousands of dollars from insurance firms who refused to pay claims for victims identical to you. This is why it's especially essential to make sure you're prepared and have the proper insurance protection in place. If your own home or personal property are broken by hurricane winds, owners insurance will typically assist cover the price of repairs.